Indonesian President Joko Widodo and US President Joe Biden earlier this week (13 November) entered talks over a potential EV minerals deal, with a focus on stimulating the bilateral trade of nickel. The early talks may potentially lay the foundations for formal negotiations between the two countries.

However, a source told Reuters that the Biden administration remains concerned about the environmental, social and governance (ESG) standards in Indonesia, and plans to consult further with US lawmakers and labour groups about a potential deal in the coming weeks.

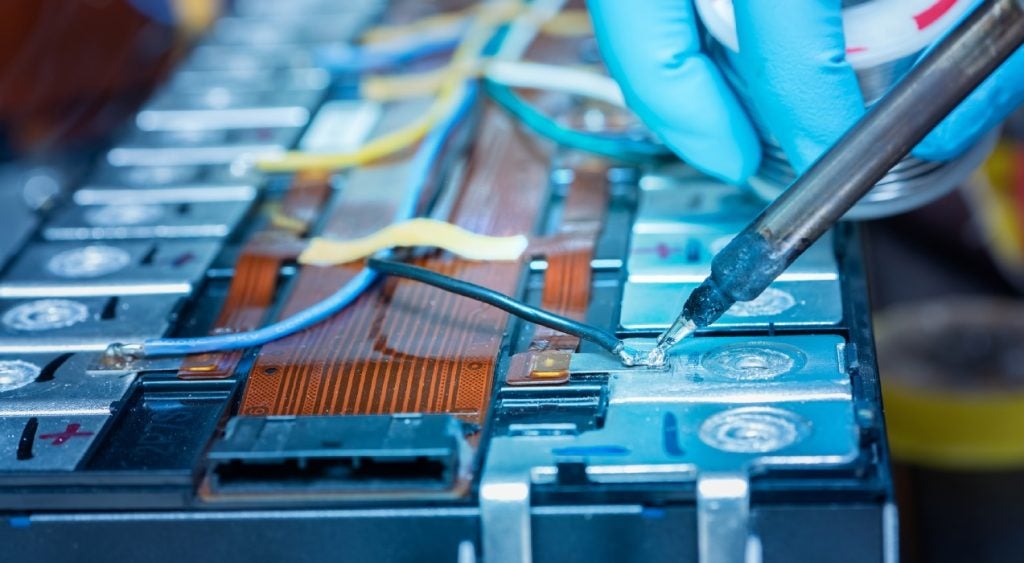

Two of the most commonly used types of batteries, nickel cobalt aluminium (NCA) and nickel manganese cobalt (NMC) use 80% and 33% nickel, respectively, with nickel used for battery cathodes and energy storage technology.

However, as automakers pledge to make their supply chains carbon neutral, the availability of high-grade nickel that meets sustainability goals has been a growing concern for OEMs and governments.

And while home to the world’s largest nickel reserves, Indonesia does not, at first glance, look like an eligible prospect for boosting the US' nickel supply.

Open pit mining of low-grade laterite nickel deposits in the country has been blamed for deforestation and water pollution, while every tonne of the metal-equivalent produced in the country is said to emit an average of 58.6 tonnes of CO2e compared to the global average of 48 tonnes.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWith Indonesia’s minerals processing industry supplied by coal-powered plants, a further 14.4GW captive coal power plants in industrial areas are now being planned for construction. Only in September, provincial authorities in the country’s mining hub of North Maluku proposed a nickel mining suspension amid environmental concerns.

A lack of significant nickel sulphide discoveries over the last decade has also pushed the likes of China’s Tsingshan Holding Group Co., the world’s largest nickel producer, to begin supplying nickel matte derived from converted nickel pig iron (NPI) from its operations at Indonesia Morowali Industrial Park. However, nickel sulphate produced in this way carries a significant carbon footprint, making it unattractive to non-Chinese OEMs.

There are also fears that a free trade agreement between Indonesia and the US could provide a backdoor for Chinese corporations. In late October, a bipartisan letter from nine US senators expressed concerns that under the Inflation Reduction Act, hostile foreign entities could benefit from generous US tax credits. They noted that investment by companies from China in Indonesia’s nickel sector reached $3.6bn in the first half of 2022 alone. They also sounded the alarm on the country’s weak labour protections, citing reports of long working hours without breaks, cuts in pay, and lack of proper safety and respiratory gear.

Moreover, the Inflation Reduction Act criteria explicitly prevent EVs with components from “foreign entities of concern,” including China, from receiving EV tax credits. The senators pointed out that Indonesia now has three plants capable of producing 164,000 metric tonnes per year of Mixed Hydroxide Precipitate (MHP), a nickel intermediate suitable for battery production, with 25 more such plants proposed for the future. All but three involve Chinese companies.

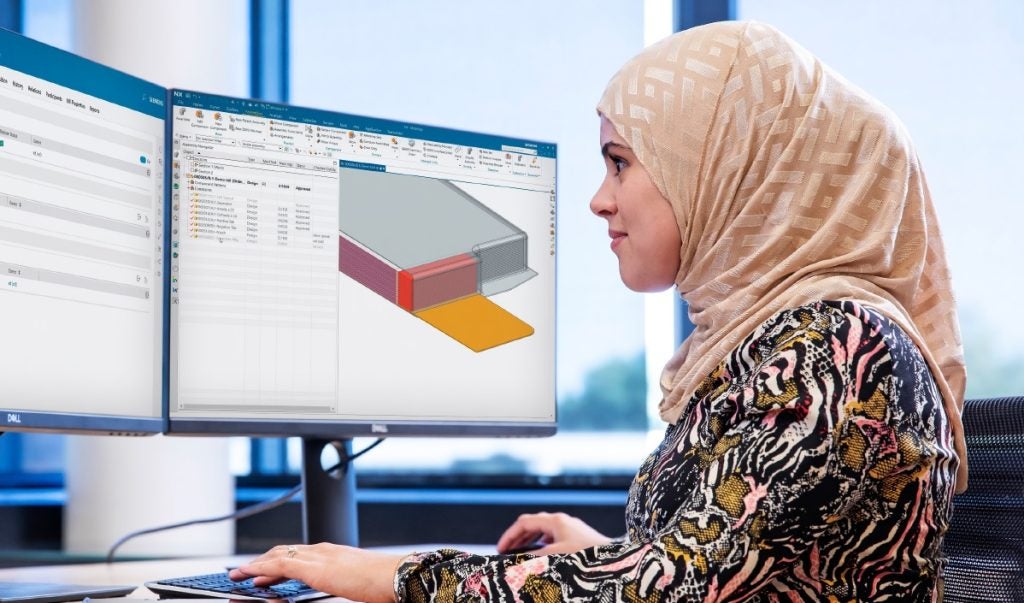

In order to fulfil the criteria of the Inflation Reduction Act and move closer to Western cooperation on EV critical minerals, Indonesia will need to take more decisive steps towards ESG compliance, invite more international firms to invest in its mining sector to prevent a Chinese monopoly, and take steps to decarbonise its coal-heavy nickel processing industry.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.