With Geely Holding’s worldwide sales rising by 20% in 2023 to 2.79m vehicles, might the Hangzhou-based OEM cross the 3m mark in 2024? The vast Chinese company seems to either create or take control of ever more brands every year. The latest list extends alphabetically from Farizon (CVs & LCVs) to Geely & Geely Galaxy, LEVC, Lotus, Lynk & Co, Polestar, Proton, Radar, Smart, Volvo Cars and Zeekr. This latest Just Auto future models report examines certain new and potentially next vehicles for many of these divisions.

London lawlessness

A rise in keyless car thefts in London emphasises the automotive industry’s need to address cybersecurity. London mayor Sadiq Khan has called on the automotive industry to address the increased theft risk of keyless vehicles, raising the question of how secure such new automotive technology is. In addition to thefts, concerns about cybersecurity in the industry across the industry raise the prospect of higher insurance premiums for consumers. Addressing CEOs of significant car brands such as Toyota, Jaguar Land Rover, Mercedes-Benz and Ford following an increase of 7.7% in the number of vehicle thefts in London, Kahn said: “I urge you to go further in the pursuit of eliminating the vulnerabilities associated with keyless vehicles and set higher industry standards for vehicular safety.” Data from the Met Police, reported by the Evening Standard, showed 60-65% of 33,000 cars stolen in the last year were keyless car thefts.

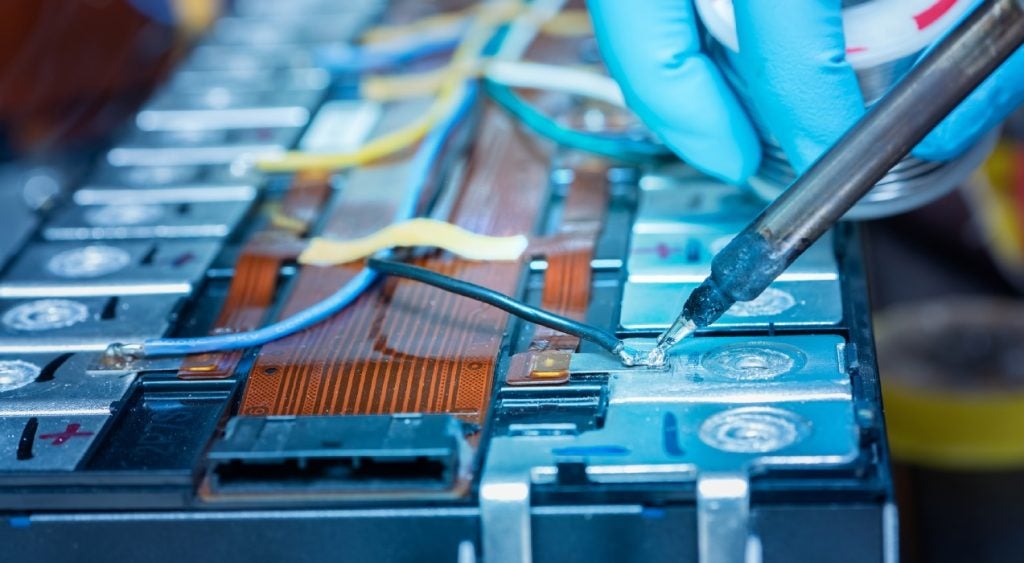

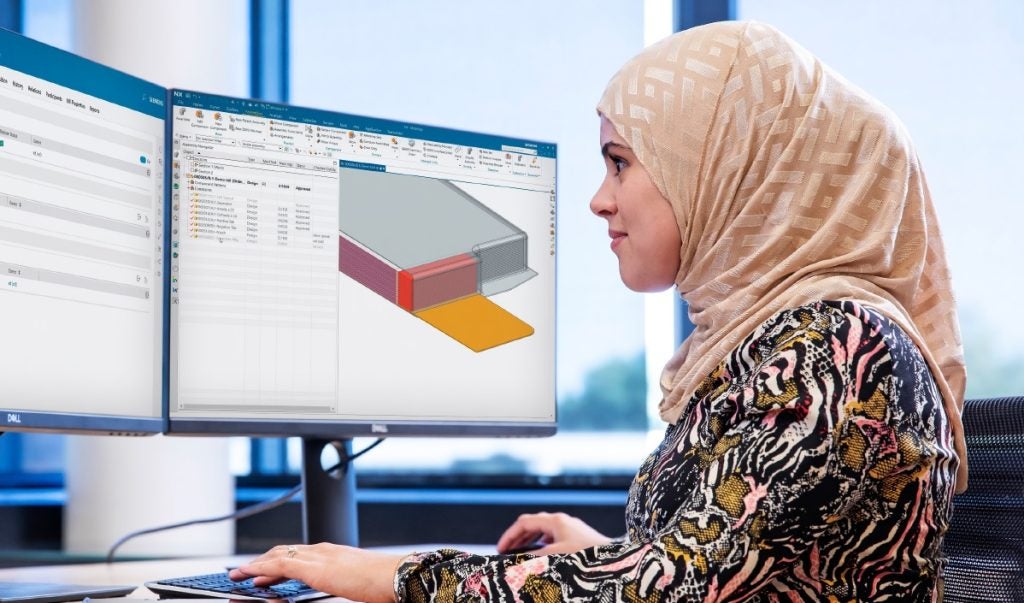

Battery tech 101

Over the past decade, the battery industry has progressed sufficiently to enable portable consumer electronics, the mobile internet, the first electric cars, and the initial adoption of intermittent renewable power storage and generation. Given stored energy’s accelerating and expanding role in tackling climate change, it will become one of the world’s most significant industries over the next ten years. This is a GlobalData guide to competing EV powertrain technologies.

Global LV sales

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGlobalData’s latest analysis of the global light vehicle (LV) market shows that the seasonally adjusted annualised selling rate (SAAR) for January slowed to 82 million units/year (compared to a like-for-like 90 million units/year in December 2023). Some 6.7 million vehicles were sold last month (that was still up 6% YoY). (From this month onwards, we will exclude exports from the China sales total, where we had previously been including them. We have backdated this adjustment to 2018.) Key markets saw selling rates fall back in January. In the US, there were signs of pricing easing back at a faster pace. In Europe, it was a mixed picture as Western Europe’s selling rate slowed while Eastern Europe’s rate improved. China’s comparable selling rate was also weaker from December to January, even though raw sales grew well, YoY.

Diesels up

According to GlobalData, January saw another month of low MoM variation in the share of new diesel car sales in the region. 2023 full year diesel share for Western Europe’s car market is confirmed at 15.8% with 1.83 million units sold in the region while pan-Europe diesel share for the year, not including CIS, was 16.0% with 2.21 million diesel cars sold. January saw another month of low MoM variation in the share of new car sales in the region that were diesel, but with share rising a little over December’s achievement, at a provisional 15.5% with a few minor markets yet to report at the time of writing. All markets lost diesel share in January on an annualised comparison basis, but Germany saw volume of diesel sales increase by 2.5k units while several other markets also saw modest volume increases. France was the biggest volume loser with January seeing diesel car sales 3.5k units lower than a year earlier. The loss of government fiscal support for plug-in cars in Germany over the last year has helped the diesel market there to maintain a level of robustness that has in turn propped up the region’s diesel car sales and share. The slowdown in BEV growth late last year (it turned negative in December, though positive again in January) has been a benefit for ICE demand in general and certainly for diesel. The migration of diesel from the mass market to the premium brands has continued.

BEVs slowing

Is the BEV market really as bad as some of the headlines indicate? Feedback from some GlobalData clients in the Battery Electric Vehicle (BEV) component supply sector indicates that, in recent months, parts volume orders are often failing to live up to earlier-stated OEM expectations and, in some cases, production lines are being idled. But is the BEV market really as bad as some of the headlines indicate? Last year Europe’s Passenger Vehicle (PV) BEV market grew 32% with positive growth in all months apart from December, which was off a very high base in December 2022. The growth achieved was better than many forecasters indicated at the start of last year (and better than in 2022), with some expecting growth to be flat. BEV sales volume came in at just under 2.1 million units which is half a million more than were sold in 2022. It is clear there has been some recent slowdown in the market, but it depends where you look. Some brands are doing considerably better than others, with the likes of MG and Tesla standing out as strong performers in 2023.

Cheap EV

BYD has launched a new version of its Qin Plus DM-I, a PHEV, with a lower starting price, of 79,800 yuan ($11,090), down 20% from its previous version. The announcement was made on Chinese social media platform Weibo, with the EV maker citing it was “Officially opening a new era of ‘electricity is lower than oil’”. BYD is the world’s largest EV maker and has been engaged with a price war with its main rival Tesla.

Startup stops

iPhi, the luxury battery electric vehicle (BEV) brand of Chinese tech company Human Horizons, has halted production as it struggled with “cut-throat” competition in the local market, according to local reports. The automaker, founded in 2017, was understood to have suspended production at its plant in Shanghai amid reports it had run out of cash, with some sources claiming it failed to pay its January wage bill. Unconfirmed reports suggested the company told employees it was shutting down production for six months starting immediately while management found a solution to the cash shortage.

US easing up on EVs

The US is set to ease proposed yearly requirements to the end of 2030 of its sweeping plan to aggressively cut tailpipe emissions and boost electric vehicle sales, two Reuters sources said. The news agency noted automakers and the United Auto Workers had urged the Biden administration to slow the proposed ramp up in EV sales because EV technology was still too costly for many mainstream US consumers and more time was needed to develop charging infrastructure. According to the report, the Environmental Protection Agency in April 2023 had proposed requiring a 56% reduction in new vehicle emissions by 2032. Under the initial EPA proposal covering 2027-2032, automakers were expected to aim for EVs to constitute 60% of their new vehicle production by 2030 and 67% by 2032 to meet stricter emissions requirements.

Second UK EV van plant

Luton will become the second Stellantis plant in the UK to manufacture electric vehicles (Ellesmere Port makes the Combo Electric). Manufacturing of an electric medium panel van for Opel/Vauxhall – Vivaro – alongside its sister versions for Citroën, Peugeot and Fiat brands will begin at the Luton manufacturing facility from the first half of 2025. Stellantis says Luton is part of the transformation to electrification of all Stellantis sites producing vans in Europe.

Have a nice weekend.

Graeme Roberts, Deputy Editor, Just Auto