Car buyers in India have been hunting for new vehicles with a vengeance, ever since the market crashed to a 10-year low during the peak of the COVID-19 pandemic in 2020 – when sales slumped by 30% from the then-all-time high of four million units in 2018.

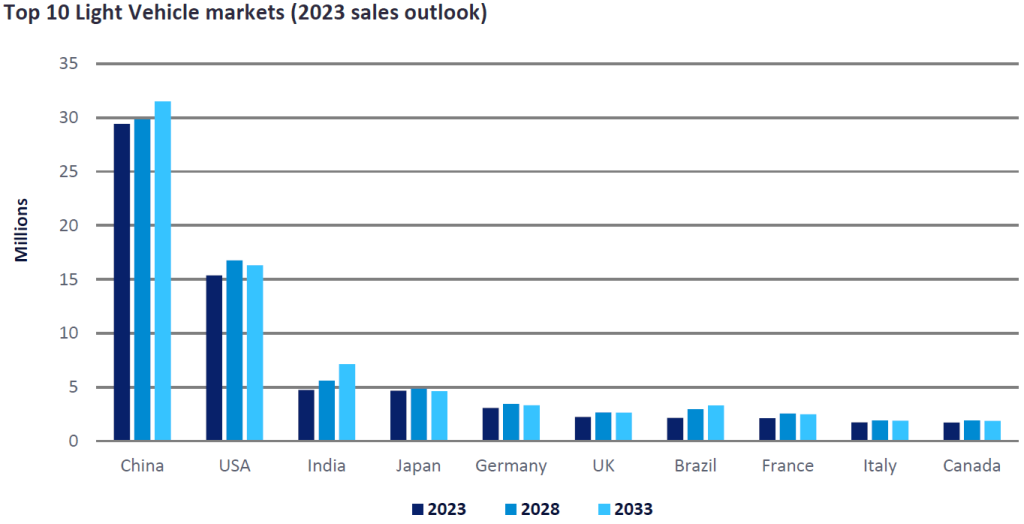

That record was shattered last year when sales neared 4.4 million units and made India the world’s third-largest Light Vehicle market behind China and the United States, albeit that position is not likely to be sustained in the short term. (See: ‘Can India remain the world’s third largest vehicle market?’.

Yet it is a significant milestone if one considers that all other major automotive markets, having reached a degree of maturity, are operating below their record levels achieved some years back.

Furthermore, we do not foresee the United States, Japan, and Germany breaking their record-high sales in 2016, 2000, and 1991, respectively. However, sales in China should surpass their 2017 record this year.

Meanwhile, the Indian market has continued to surprise us on the upside. In October, monthly Light Vehicle wholesales reached an unparalleled 449,000 units. Sales were up by 7% month-on-month over the previous month’s peak and by 16% year-on-year.

Inventory build-up for the festive season and increased output (thanks to improved supply of semiconductors) helped to boost wholesales results in October. Sizeable discounts and incentives from OEMs and dealers also sustained sales momentum in the month. It appears that sales in rural areas started to recover after below-average monsoon rainfall had an impact on rural incomes.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCumulative Light Vehicle wholesales between January and October thus neared four million units, which represented growth of 8% year-on-year. Yet, the number of backlogged orders (of mostly Passenger Vehicles) is at 500,000 to 600,000 units – which is equivalent to 1.5 to 2 months of Passenger Vehicle sales in the country.

Market leader Suzuki had an order backlog of about 215,000 units by the end of October, which was down from the peak of 400,000 units a few quarters ago. Other OEMs with high pending orders include Mahindra (286,000 units as of 1 November) and Hyundai (115,000 units).

Consequently, we have raised our 2023 outlook by 2%, from 4.6 million units in January to 4.7 million units currently because of the stronger-than-expected sales performance. We have also hiked our short-term projections by 6% on average and our long-term estimates by 7-17% versus our forecasts at the start of the year.

Nevertheless, several concerns make us cautious about the near-term sales outlook. Vehicle prices are estimated to have increased by 20-30% in the past two years (due to the implementation of the BS-VI emission standard, stricter safety regulations, and higher costs of materials and production). Financing costs remain high as well.

In the overall economy, the general elections in April-May 2024 pose some uncertainty. Although Prime Minister Narendra Modi’s ruling party is widely expected to win, a new government normally pauses and reviews fiscal spending.

In the long term, we predict India’s Light Vehicle sales will expand at a compound annual growth rate (CAGR) of 4% over the next decade, versus 5.5% in the ten years pre-COVID-19 (2009-2019). By comparison, the CAGRs for China, the United States, and Germany are calculated at a mere 1% over the same timeframe. And we see no expansion in Japan.

That puts India, along with Brazil (CAGR 4% 2023-2033), as the fastest-growing Light Vehicle market with one million-plus annual sales. However, the size of the Brazilian market is roughly half that of India.

Lastly, our growth forecast for India puts it at the No. 3 spot on a permanent basis from 2026 onward.

Ammar Master, Director, South Asia, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center