At the beginning of the development of the NEV (New Energy Vehicle) market, most car makers built their NEVs on combustion engine vehicle underpinnings, modifying traditional platforms to enable them to support BEV and PHEV powertrains.

However, during the research and development period, a lot of problems were encountered, and products were often sub-optimal in terms of performance and electric driving range. As technology has moved on, this transition concept has been gradually replaced by dedicated platforms designed exclusively for battery electric cars. Examples of this transition are provided by Volkswagen which developed BEV versions of Lavida, Bora, and Golf models, only to withdraw them from their portfolio with the arrival of pure electric vehicles based on BEV-only platforms. Today, most cars have completed or are in the process of switching to exclusive BEV platforms.

However, BMW remains almost unique in continuing to release BEVs on flexible platforms which can also support combustion powertrains. Even more surprising is that BMW’s sales are doing very well. How does BMW manage it?

BMW pitches its offerings as the “Ultimate Driving Experience” and a high-end brand. Its main advantages revolve around the driving experience, the so-called “Pure Driving Pleasure.” These long-standing genes have been brought into full play with the advent of the NEV era. Owning a BMW is a dream of most Chinese male car consumers, attracted by the claims mentioned above.

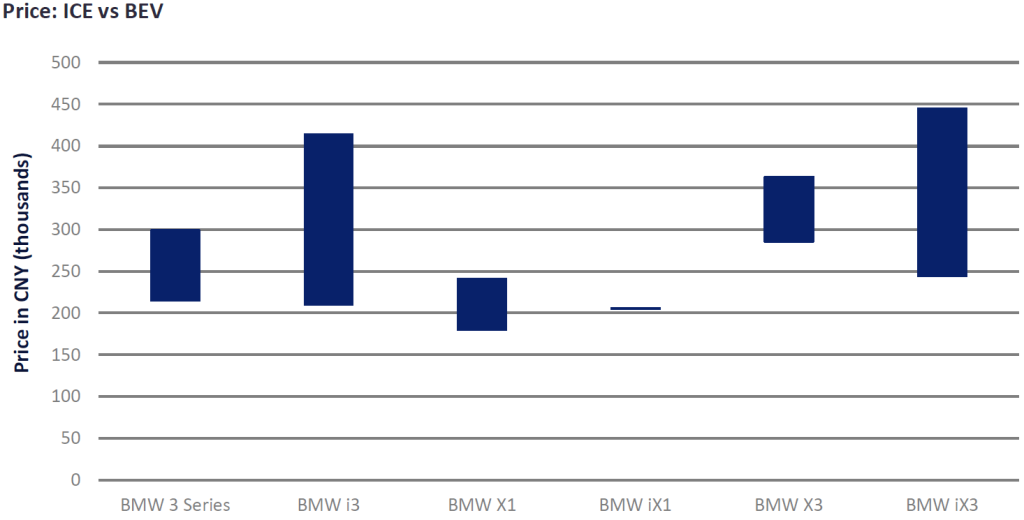

A smart pricing strategy. When NEVs launch in the market, the price points are often higher than those of equivalent traditional combustion vehicles. Mercedes-Benz is a good example of this. Its EQC model can be seen as a BEV version of the GLC, and when it launched in the market, the starting price was close to CNY500k, and no discounts were on offer. Though the GLC’s price was also as high as CNY500k, it offered several additional features over the EQC as standard as well as discounts and the value imbalance with the GLC became obvious. The EQC is not alone in this situation, but the disparity is the biggest. In contrast, BMW’s BEVs are much cheaper than comparable ICE models, and benefitting from purchase tax exemption (as BEVs do in China), they have attracted a lot of consumers. At the same time, its BEV products have managed to maintain the “Ultimate Driving Experience.”

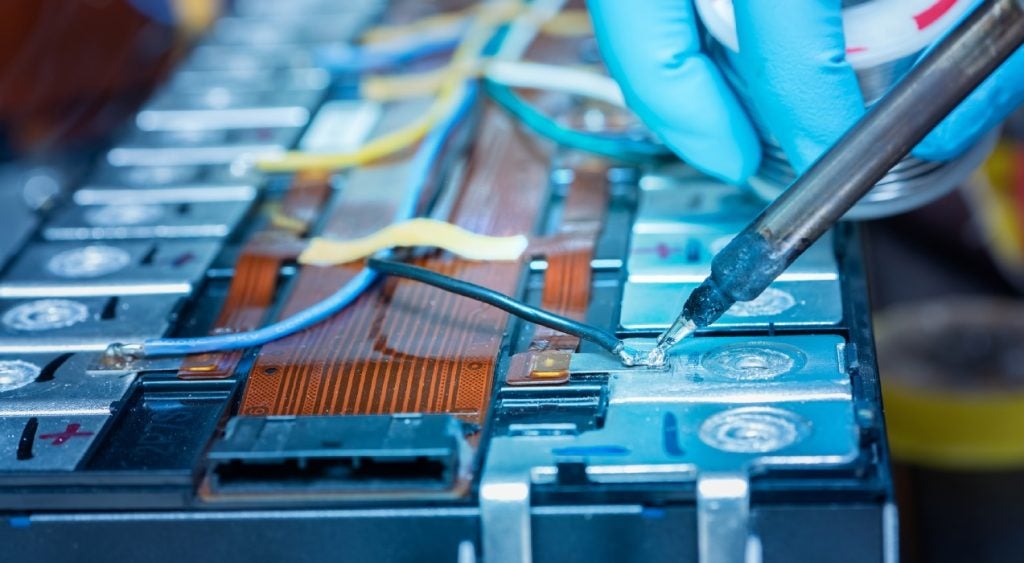

BMW has a strong track record of vertical integration of key NEV component development, in particular e-motors and batteries which are critical to NEV performance and durability. BMW accumulated rich experience when developing the i3 and i8 models while its 5th generation eDrive system offers a comprehensive evolution in batteries, motors, and electronic control systems. It achieves multi-dimensional technological innovations in power density, range, lightweighting, miniaturization and modularization. Its motor is a type of excitation motor, which is based on the permanent magnet motor but replaces the permanent magnets with a set of excitation coils. The benefit is that it can more efficiently adjust the current and power factor. There is a saying that this motor is the equal of two motors for some other brands. In other words, it provides a way for simultaneous cost reduction and power optimization.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAt the same time, to control costs, BMW is making China an export hub, delivering vehicles produced there all over the world. Using these global sales channels has helped the brand create a new image in the NEV era. We believe that this smart strategy will enable BMW to be the first among foreign brands to reach its China e-mobility targets.

Yan Zhang, Powertrain Market Analyst, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center

Related Company Profiles

Volkswagen AG

Mercedes-Benz Group AG