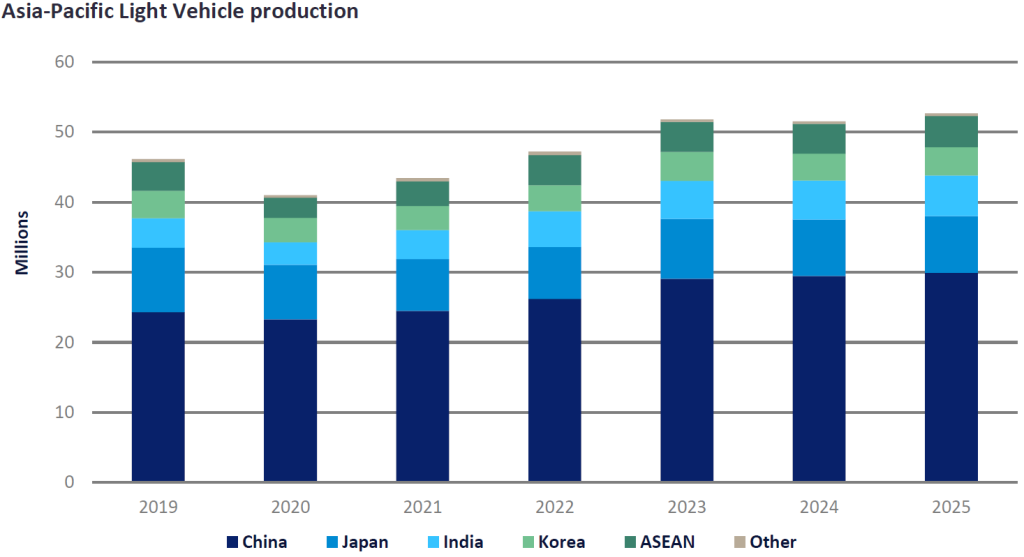

Asia-Pacific’s Light Vehicle (LV) production ended 2023 on a high note. The region’s production expanded nearly 10% year-on-year (YoY) to a record-high level of 51.8 million units thanks to the robust pace of production in China and Japan, and to a lesser extent, Korea and India. Strong exports were a key driver for growth in the mainland and China became the world’s largest vehicle exporter last year.

This year will be a different story. The region’s 2024 output is expected to be slightly lower compared to last year. That is not a bad result and reflects normalised production given the high level of output in 2023. With backlogged orders being reduced in Japan and India, production will revert to a more typical level. On the demand front, sales have been softening in most markets in the region now that pent-up demand following the pandemic has been satisfied.

Production growth is set to moderate across many markets in Asia and even fall into negative territory in Japan, Korea, Malaysia and the Philippines. In Japan, Light Vehicle sales dropped 12% YoY in January, the first YoY decline in 17 months. While the primary cause of the sales decline was Daihatsu’s suspension of production and deliveries, the overall market is generally weakening now that pent-up demand and backlogged orders are filled. LV sales are expected to expand by less than 3% YoY in 2024, compared to a 14% increase last year.

Daihatsu has suspended shipments of all its vehicles since late December after the scandal and investigation into its safety tests. Preliminary data indicate that Daihatsu sales in Japan dropped 63% YoY in January, which led to a 23% decrease in total Mini Vehicle sales. However, the government has approved the delivery resumption for fifteen of the twenty-seven suspended models, and Daihatsu is to resume production in February. As such, sales are likely to rebound in the coming months.

Our view is that Daihatsu could lose between 5% and 20% of its sales in Japan through to next year, depending on whether or not (and when) the remaining twelve suspended models pass the re-inspection. In any event, there will be limited impact on the overall market volume since the void left by unfulfilled sales of the Daihatsu models can, and is likely to be, filled by other Kei car manufacturers.

Another incident that occurred in January which has affected Japan’s February sales was Toyota’s suspension of ten of its models, including the Landcruiser and the Hiace, after the company found irregularities in certification tests for diesel engines developed by its affiliate, Toyota Industries. It is not clear at this point when Toyota will be able to resume shipment of these models, pending the results of their

re-inspections. Again, even if the results are unfavorable, the suspension is expected to have a negligible impact on market volumes.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataExports are more at risk in Japan with increasing pressure in the Battery Electric Vehicle (BEV) space and the relatively weaker BEV offerings among Japanese brands. That, and the fact that BEVs are increasingly built where they are sold to be eligible for tax cuts and/or incentives, will negatively impact Japan and other key exporters, especially ones with significant shipments to North America and Europe. In Asia-Pacific, the risk is also an imminent one for Korea.

It is a different story in Southeast Asia (SEA) where LV sales have been softening and exports are the crutch that cushions the impact on production. SEA’s main export destinations including that for future BEVs are within SEA itself, in Oceania, and in other emerging markets which have less production localisation risk.

However, there is increasing risk to exports and therefore to production in Asia from the Red Sea crisis which has prompted freight reroutes that have been costly and caused weeks of delay. There is also rising concern that a prolonged conflict in that area could lead to another global supply chain bottleneck, in addition to increasing logistics costs.

May Arthapan, Director, Asia-Pacific, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center

Related Company Profiles

China Gas Holdings Ltd

Japan Post Holdings Co Ltd

Korea Gas Corp

Indian Oil Corp Ltd

Toyo Tanso Co Ltd