Domestic sales by South Korea’s five main automakers combined fell by almost 13% to 114,905 units in December 2023 from 131,812 a year earlier, according to preliminary wholesale data released individually by the manufacturers. The data do not include sales by South Korea’s low-volume commercial vehicle manufacturers including Tata-Daewoo and Edison Motors, while import brands are covered in a separate report later in the month.

The market last month was driven lower by surprisingly weak performances by the country’s leading automakers, Hyundai and Kia, while KG Mobility and Renault Korea continued to see the volumes plunge. Only GM Korea saw its sales grow last month, by 20%, albeit from very weak year-earlier levels.

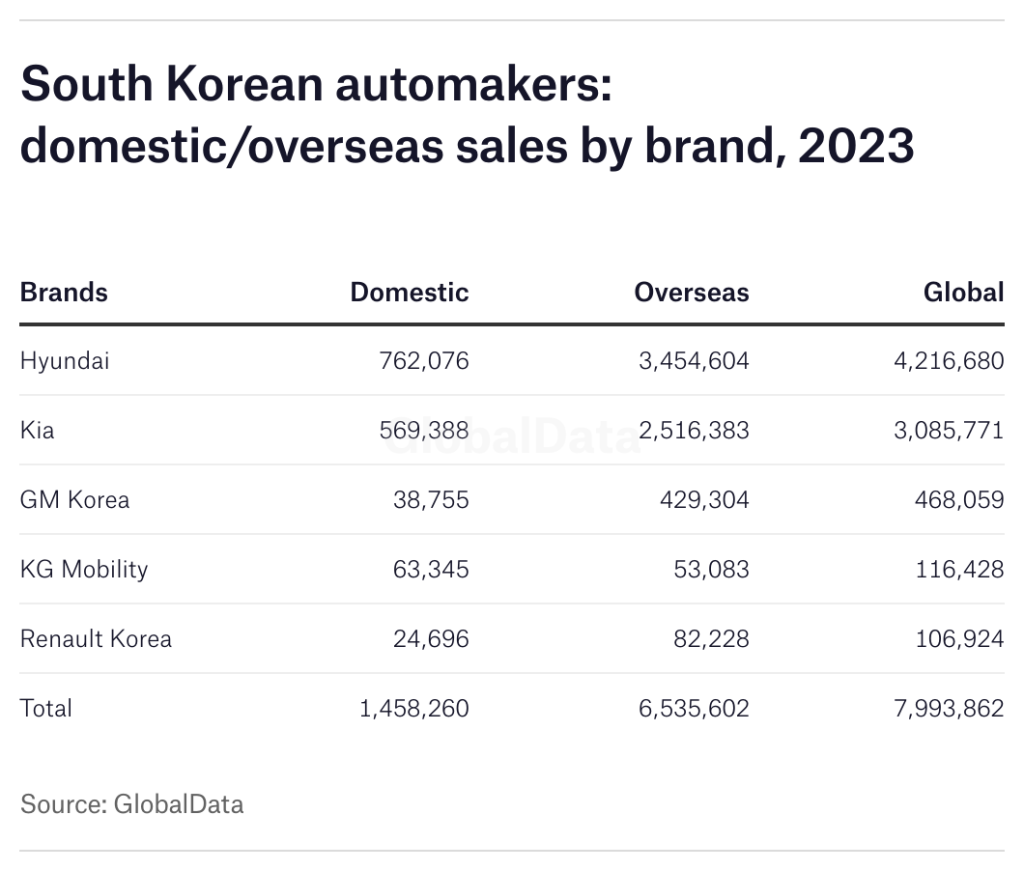

Over the full year the domestic vehicle market expanded by 5% to 1,458,260 from 1,389,795 units in 2022, driven by a strong performance by Hyundai which reported an almost 11% increase to 762,077 units. Kia’s sales rose by 5% to 569,388 units last year, while GM Korea reported a 4% increase to 38,755 units. KG Mobility’s sales fell by over 8% to 63,345 units, while Renault Korea’s local deliveries plunged by 53% to 24,696 units.

Global sales among the country’s “big-five” automakers, including vehicles produced overseas by Hyundai and Kia, fell by 4% to 621,244 units in December from 646,639 units a year earlier, reflecting mainly a sharp decline in Kia’s sales. Full-year sales were more than 8% higher at 7,993,862 from 7,393,195 units – helped by improved supplies of semiconductors following last year’s shortages. Overseas sales increased by 3% to 506,339 units last month from 491,444 units and were up almost 9% at 6,535,602 units in 2023 from 6,009,330 units.

Hyundai Motor’s global sales fell by 1% to 342,919 units in December from 348,280 a year earlier, reflecting mainly a sharp decline in domestic sales. Total deliveries last year were up by almost 7% at 4,216,680 units from 3,942,922 in 2022, help by improved supplies of semiconductors. The automaker missed its target of selling 4.32 million vehicles last year, with both domestic and overseas sales falling short.

Domestic sales fell by almost 12% to 62,172 units in December from 70,387 units a year earlier, after surging by 18% in November, while full-year sales were up by almost 11% at 762,077 from 688,884 units – reflecting strong demand for the all-new Grandeur sedan and the company’s strong SUV range. Last year the company also launched the all-new Kona compact SUV, including an all-electric variant, and the all-new Santa Fe mid-sized SUV.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataOverseas sales increased by 2% to 280,747 units in December from 275,294, while full-year volumes were up by over 6% at 3,454,603 units from 3,254,038 – reflecting mainly strong demand for its SUVs in key regional markets including North America, Europe and India.

This year Hyundai is targeting global sales, including the Genesis brand, of 4,243,000 units – just slightly higher than last year’s volumes, including 762,000 domestic sales and 3,455,000 overseas.

Hyundai confirmed plans to optimise its product portfolio and vehicle supply management for each region this year to maximise profitability. It also said it plans to strengthen EV production, establish flexible business strategies to adapt to market changes and “reinforce pre-emptive risk management capabilities”.

Last month Hyundai was reported to have decided to postpone the launch of the Ioniq 7 full-size electric SUV by five months to December 2024, to prioritise the introduction of cheaper EV models for which global demand is expected to be much stronger.

Kia’s global sales fell by over 9% to 213,543 vehicles in December from 255,836 a year earlier, reflecting sharply lower domestic and overseas deliveries. Over the full year total sales rose by over 6% to a record 3,085,771 units from 2,901,797 units in 2022, driven by strong demand for SUVs including the new Sportage, Seltos and Sorento. This was short of the company’s ambitious target of increasing sales by 10% to 3.2 million last year, with both domestic and overseas sales falling short.

Domestic sales fell by almost 11% to 45,418 units last month from 50,822 a year-earlier, despite strong demand for its SUVs and for the Carnival MPV. Total domestic sales last year were up by 5% at 569,388 units from 542,754 in 2022. Overseas sales fell by 9% to 168,125 units in December from 184,230 a year earlier, but were up by 7% at 2,516,383 over the full year from 2,359,043 units, reflecting robust demand for the Sportage, Seltos and K3 models in key regional markets including North America, India and Europe.

Kia said it aims to sell 3.2 million units in 2024, including 530,000 domestic sales, 2.663 million overseas and a further 7,000 special purpose vehicles. The automaker said it will continue to expand its EV range in global markets with the launch of the new EV5 compact electric SUV and the EV6 electric sedan this year, following the global roll-out of the EV9 SUV, Carnival MPV and the facelifted K5/Forte sedan in the fourth quarter of last year.

Kia confirmed it aims to complete the redevelopment of its Kia AutoLand Gwangmyeong EV plant this year, which will produce the compact EV3 and EV4 for domestic and overseas markets. The automaker’s medium-term plan is to sell 4.3 million vehicles annually by 2030, of which 1.6 million units are expected to be electric vehicles (EVs).

GM Korea’s global sales more than doubled to 51,367 vehicles in December from 23,752 units a year earlier, as the automaker continued to enjoy a strong rebound following the introduction of the new Trax crossover vehicle at its Changwon plant early last year. Full-year sales surged by 77% to a record 468,059 units from 264,875 in 2022, with the Trailblazer SUV and Trax crossover vehicle each selling around 210,000 units.

Local sales rose by 20% to 2,214 units last month from 1,840 a year earlier and were 4% higher at 38,755 units last year from 37,237 – underpinned by the new Trax and Trailblazer models. Other GM models sold locally include the Bolt EV, the Colorado and Sierra Denali pickup trucks and the Equinox, Traverse, Tahoe and Cadillac Lyric SUVs.

Exports surged by 112% to 49,153 units in December from 21,912 a year earlier and by 92% to 429,304 over the full year from 223,568 units.

KG Mobility’s (formerly SsangYong) global sales continued to fall sharply in December, by 27% to 6,608 units from 9,094 a year earlier, reflecting sharply lower domestic and export sales. The company, previously known as Ssangyong Motor, was acquired last year by a consortium led by local steel and chemicals firm KG Group. Full-year sales were up by over 2% at 116,428 units from 113,960 previously, reflecting strong growth in the first half of the year.

Domestic sales plunged by over 36% to 3,507 units last month from 5,520 a year earlier and were down by over 8% at 63,345 units in 2023 from 68,666 – as competition continued to intensify. In September the company launched the new Torres EVX SUV powered by a lithium iron phosphate battery pack, its second battery-powered model after the launch of the Korando Emotion in early 2022.

Exports fell by 13% to 3,101 units in December from 3,574 units, despite the company having signed a number of large export orders from Middle-Eastern distributors in the last two years – including a contract to supply 170,000 CKD kits to Saudi Arabia over an eleven-year period and a further 7,000 built-up vehicles to be exported to the UAE. Full-year exports were still up by 17% at 53,083 units from 45,294 units, reflecting a strong rebound in the first half of the year.

KG Mobility has yet to finalise the acquisition of bankrupt Edison Motors Company Ltd, a local electric commercial vehicle manufacturer that just over two years earlier had successfully bid to acquire Ssangyong Motor from bankruptcy but failed to complete the acquisition. KG Mobility is also involved in a legal battle to retain the KG Mobility trademark after it was registered by an unrelated company earlier last year.

Renault Korea‘s global sales plunged by 30% to 6,807 vehicles in December from 9,677 units a year earlier, with local sales and exports both declining sharply. Total volumes last year were down by 37% at 106,924 units from 169,641 units, with the XM3 its best-selling model with some 78,000 sales, followed by the QM6 and SM6 models.

Domestic sales plunged by 51% to 1,594 units last month from 3,243 a year earlier, as the company continued to struggle with rising competition from domestic manufacturers and from imported brands, while full-year sales were down by 53% at 24,696 from 52,254 units. Exports fell by 19% to 5,213 units in December from 6,434 a year earlier and by 30% to 82,228 in 2023 from 117,387 units.

Renault Korea plans to add more hybrid vehicles to its line-up to help revive local sales, with a version of the XM3 compact SUV the only hybrid model currently in its line-up. The company is also understood to be making preparations to produce a Geely-based mid-sized hybrid SUV model in the second half of 2024 under its “Aurora 1” programme

Late last year Renault Korea announced it had reached an agreement with China’s Geely group to produce the Polestar 4 model at the Busan plant from the second half of 2025, for sale domestically and for export. It will be the company’s first battery electric vehicle (BEV) model to be produced in the country. Management have also been discussing sourcing EV batteries from local producers including LG Energy Solution, SK On and Samsung SDI.

To help improve the domestic appeal of its vehicles, Renault Korea signed a memorandum of understanding (MOU) last month with local firm TMAP Mobility Company to co-develop infotainment systems for future models.